Investors more bullish on Treasuries, expect soft-landing

Russell’s survey September 2006: Managers Foresee Soft Landing

Slower growth lies ahead for the United States, say investment managers who responded to Russell Investment Group’s September quarterly survey.

They believe the Federal Reserve Board has engineered a soft landing and are looking for stocks to perform in line with longterm market expectations. Anticipating no further increases in interest rates, they have raised their outlook for U.S. Treasuries and corporate bonds to their highest levels since the poll was launched two years ago.

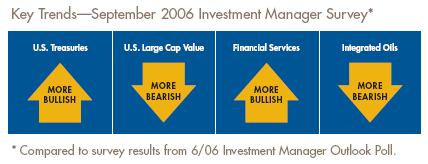

None of the managers surveyed believes a recession is likely in the next 12 months, but half see slower growth ahead and four in 10 foresee growth similar to the 2.9 percent economic growth recorded in the last quarter. Most managers remain convinced that it is only a matter of time before large-cap growth stocks take off and continue to be more bullish on that asset class than any other. But here, too, their bullishness has fallen to the lowest level in two years. At the same time, more managers view the market as undervalued than at any time since the survey began, although that number still trails those who see it as fairly valued. Although managers have raised their outlook for bonds, they have lowered it even further for real estate investment trusts, which now occupy last place in terms of bullishness. The outlook for the energy sectors, too, is the lowest since the survey began. Clearly managers believe that oil prices have peaked, at least for now, with tensions lessening in the Middle East and the 2006 hurricane season appearing to be mild. Overall, managers see a sustained period of “average” growth ahead in which the selection of individual stocks will be more important than being in the right sectors.