US exorbitant privilege revisited

The paper by Gourinchas and Rey identified US exorbitant privilege as ability of the US to earn much more on its foreign assets (7%) than cost of its foreign liabilities (3.5%). Among many arguments explaining why this was possible is one that US financial markets are biggest, most liquid, with best regulatory framework. I have been arguing for a long time that this privilege will slowly go away amid rapid development of financial markets in other parts of the globe.

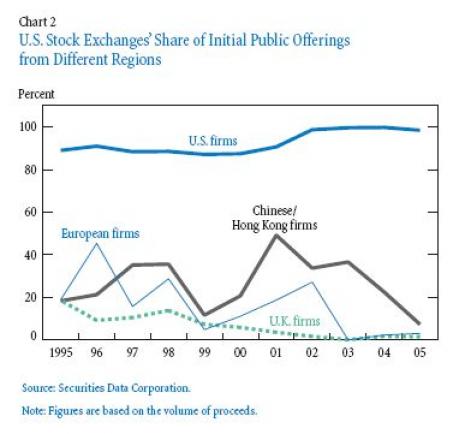

Recent paper by New York Fed economist Stavros Peristiani provides a nice overview on this topic, showing that US markets are loosing global importance, in a most pronounced way with respect to global bond markets. It is also worth noticing, that while home bias among investors has been falling (with hedge funds contributing to this process, with Feldstein-Horioka puzzle vanishing in the last decade) at the same time the home bias with respect to IPOs and new bond issuance has been on the rise. It does reflect positive corporate governance developments in Asia, creation of euro market and predatory regulations in US following the Enron case.

Mean-reversion minds are predicting US dollar strengthening from historically low levels. They might be right, but the above trends of strengthening home IPO bias combined with SWF diversification policies argue for further dollar weakness. See chart from Peristiani paper below:

Two links added later: